Change is Coming! What to Know

Let’s dive into discussions about the changes coming from the NAR settlement, how to stay ahead of the changing real estate landscape and ensure you have a high level of mastery of contracts and expectations for compliance.

Queta Villalpando 210-663-4978 Broker Associate

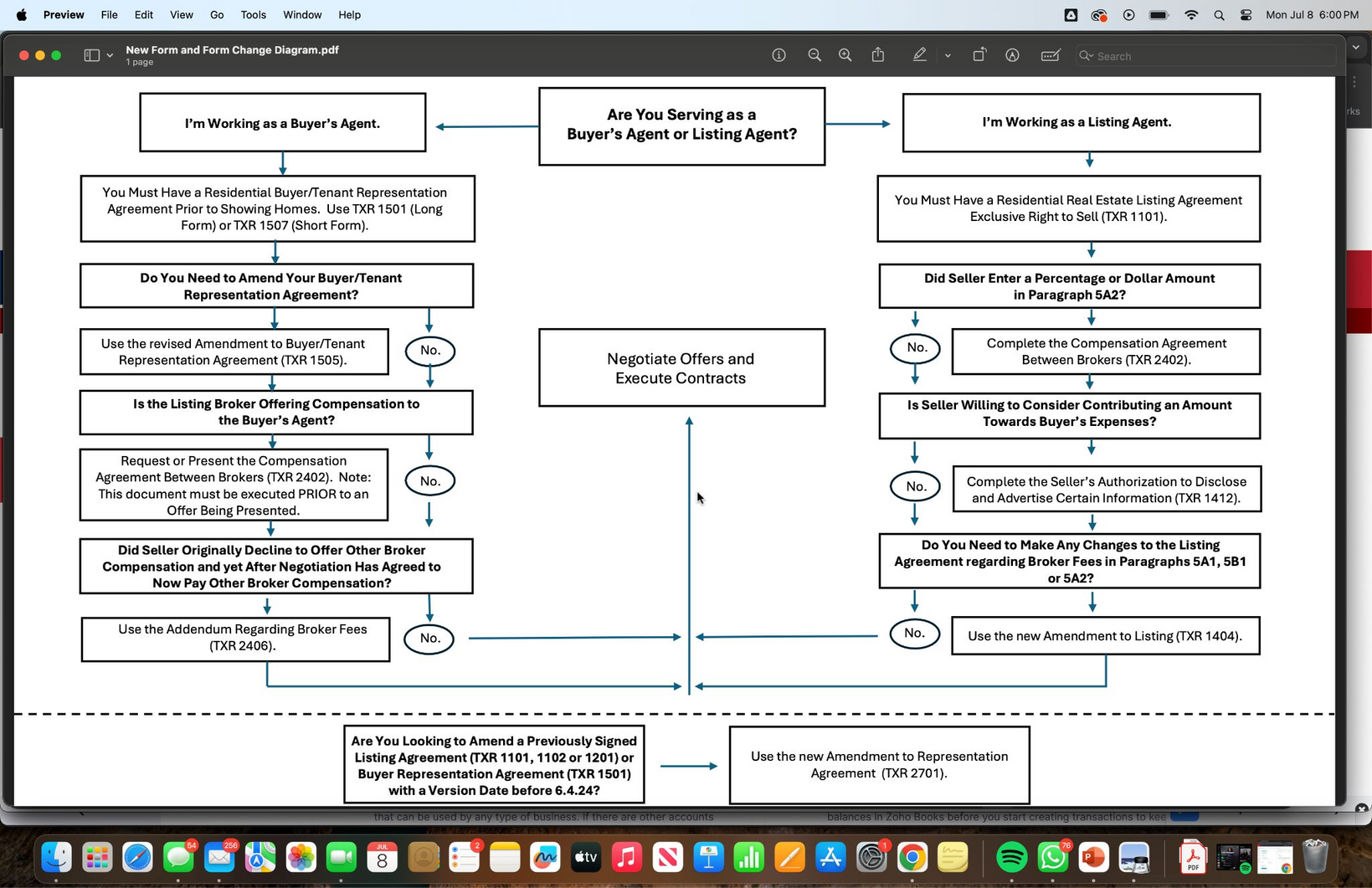

Updated Forms

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

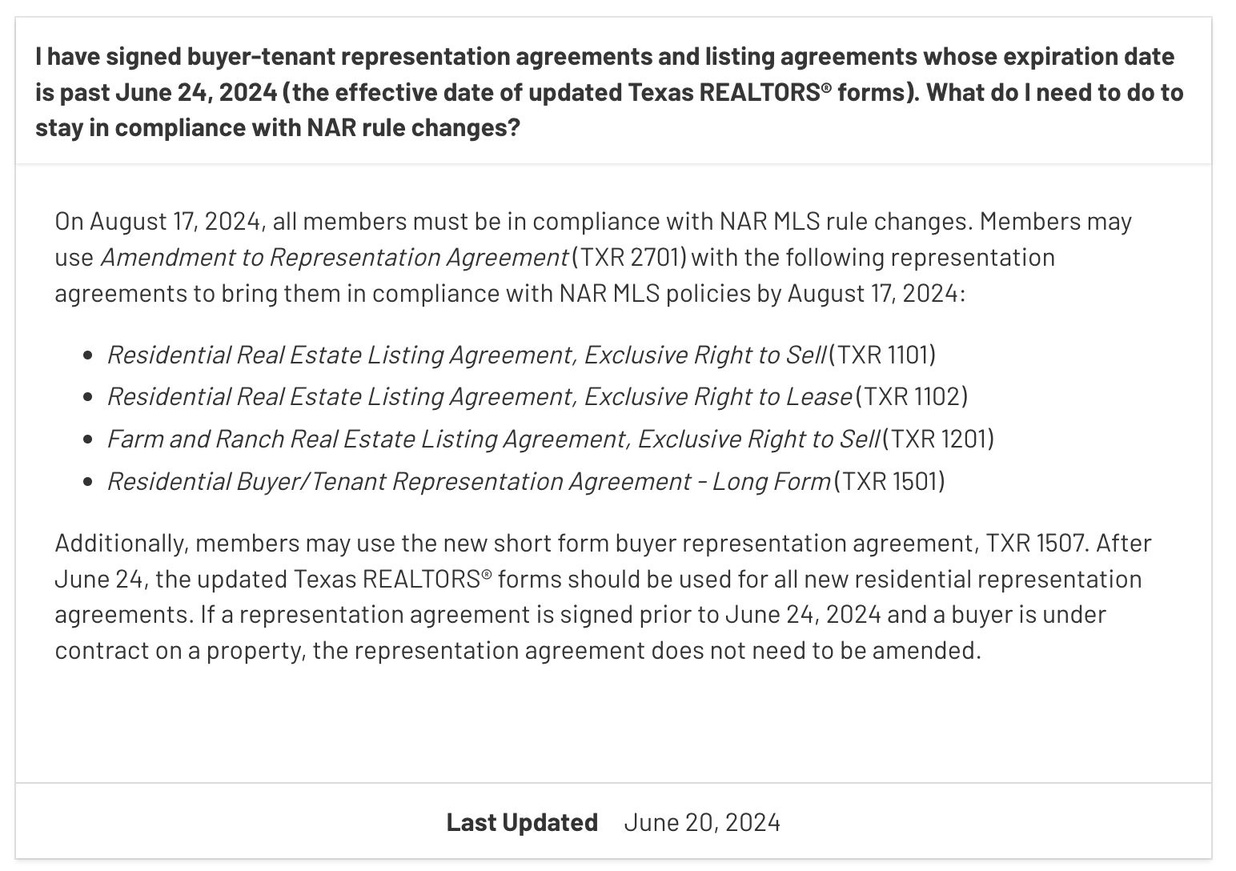

Residential Real Estate Listing Agreement, Exclusive Right to Sell (TXR 1101)

Residential Real Estate Listing Agreement, Exclusive Right to Lease (TXR 1102)

Farm and Ranch Real Estate Listing Agreement, Exclusive Right to Sell (TXR 1201)

Named Exclusions Addendum to Listing (TXR 1402)

Exclusive Agency Addendum to Listing (TXR 1403)

Amendment to Listing (TXR 1404)

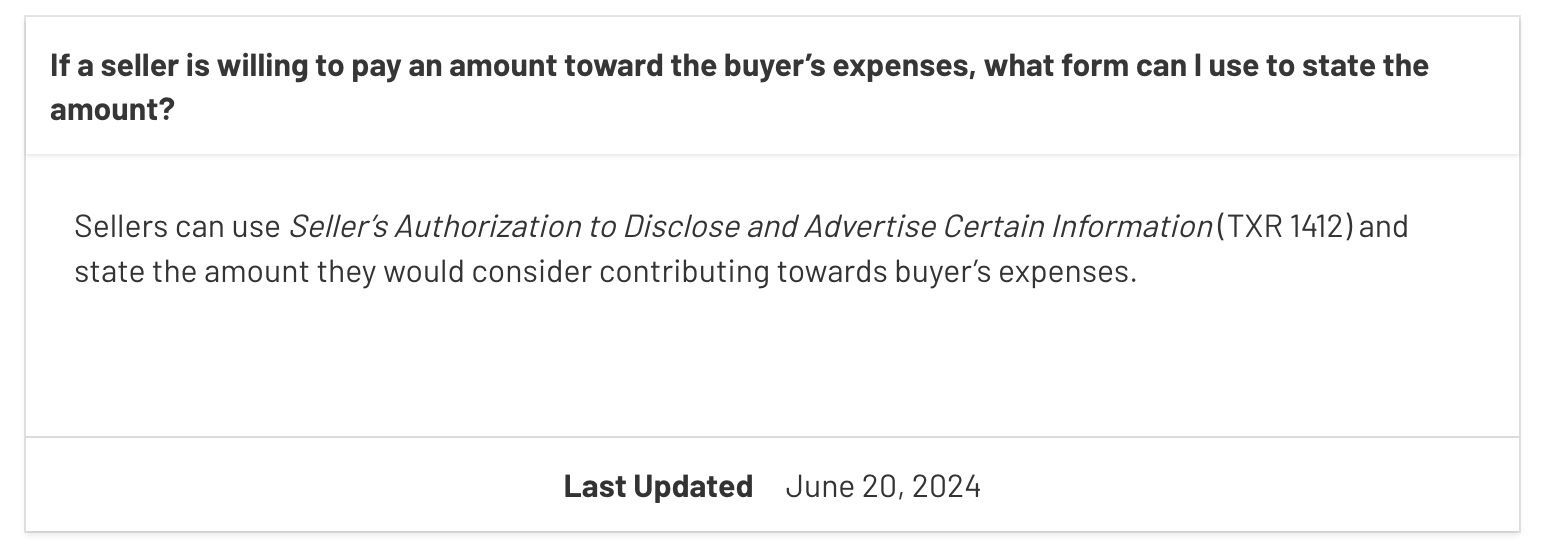

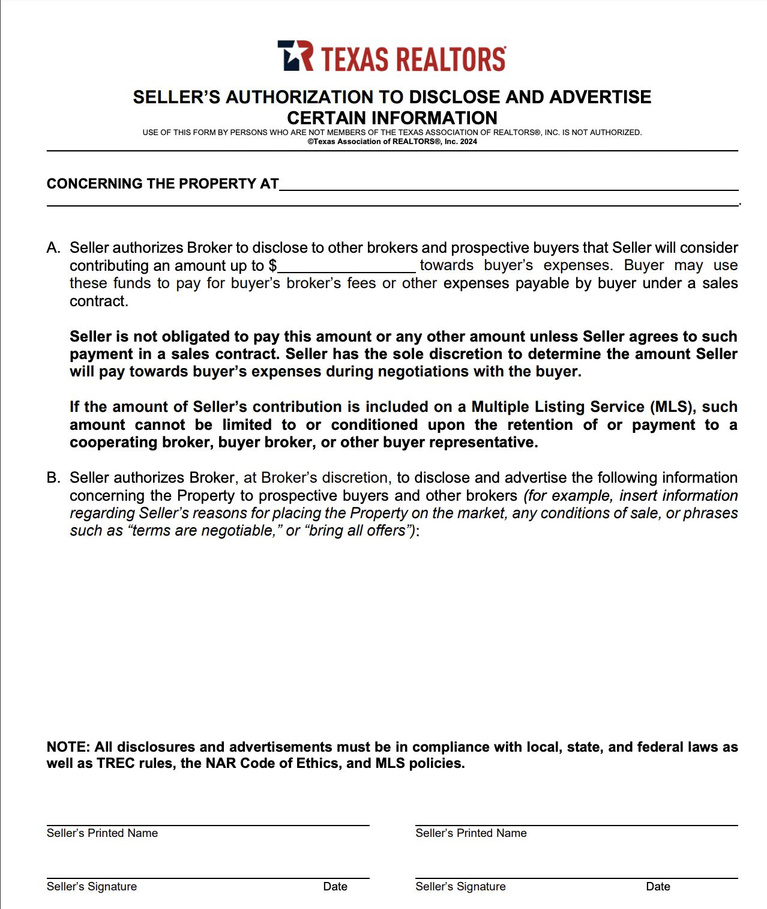

Seller’s Authorization to Disclose and Advertise Certain Information (updated name) (TXR 1412)

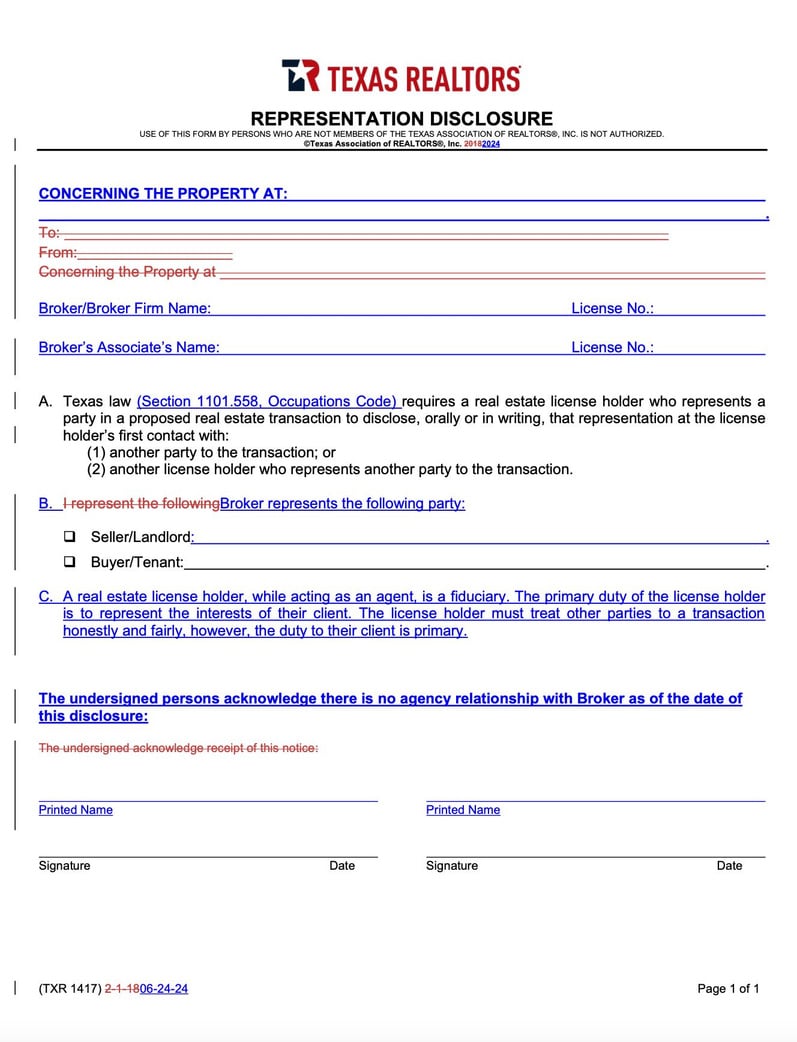

Representation Disclosure (TXR 1417)

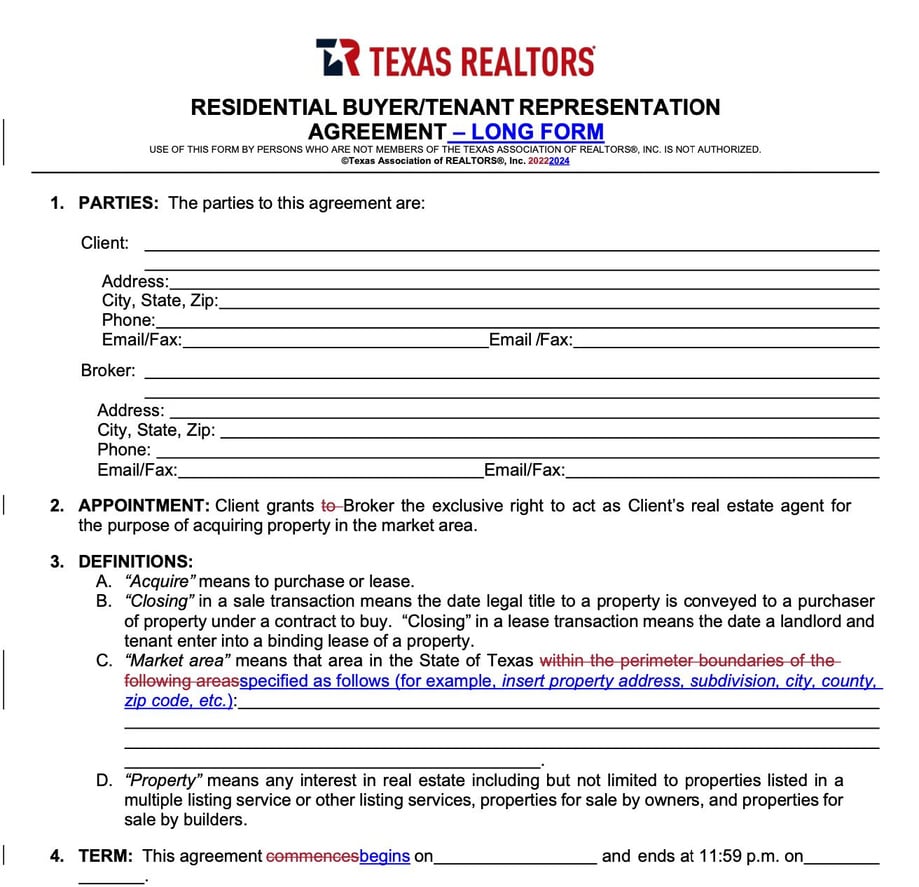

Residential Buyer/Tenant Representation Agreement – Long Form (updated name) (TXR 1501)

Amendment to Buyer/Tenant Representation Agreement (TXR 1505)

General Information and Notice to Buyers and Sellers (TXR 1506)

Residential Leasing and Property Management Agreement (TXR 2201)

Independent Contractor Agreement for Sales Associate (TXR 2301)

Compensation Agreement Between Broker and Owner (updated name) (TXR 2401)

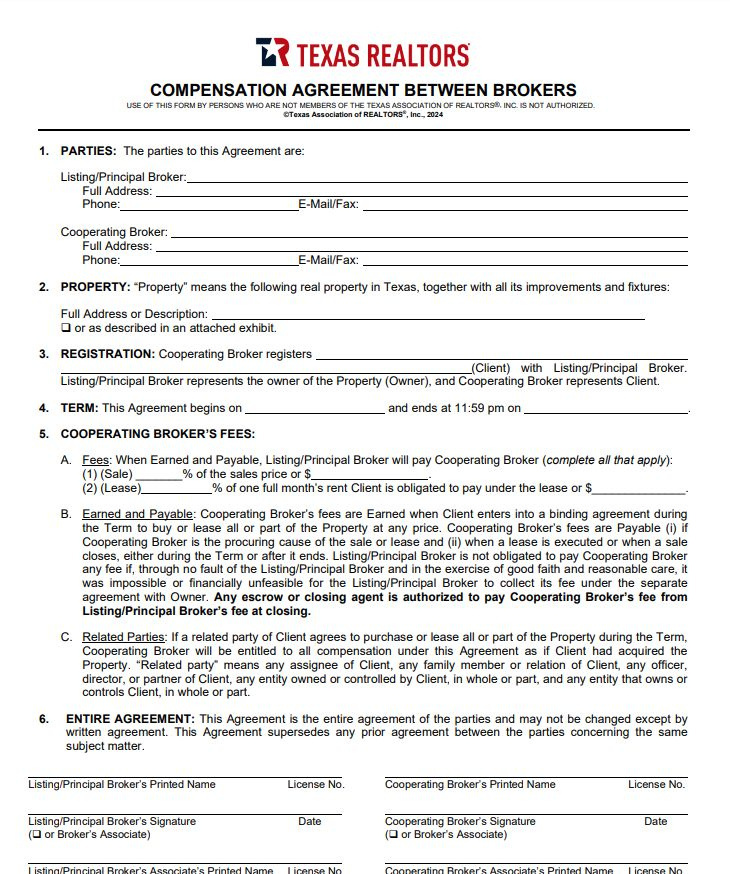

Compensation Agreement Between Brokers (updated name) (TXR 2402)

Referral Agreement Between Brokers (TXR 2405)

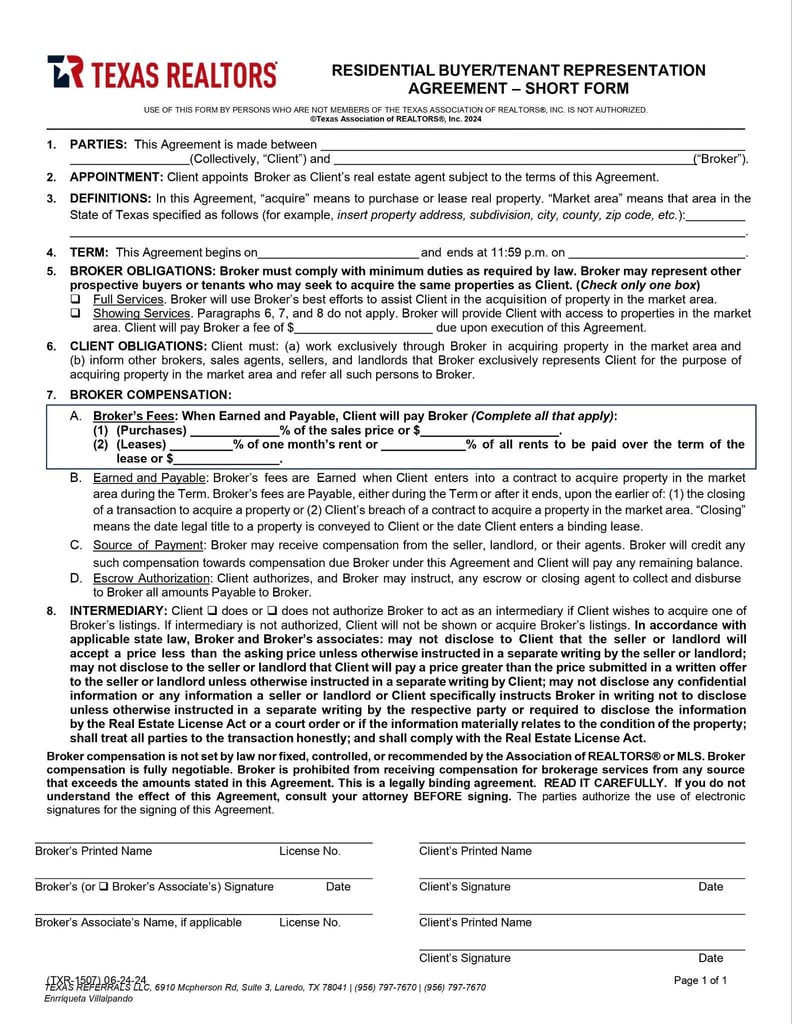

New Forms

●

●

●

Residential Buyer/Tenant Representation Agreement – Short Form (TXR 1507). A one-page version of TXR 1501, this form can be

used for full or showing service only representation of a buyer or tenant in residential transactions.

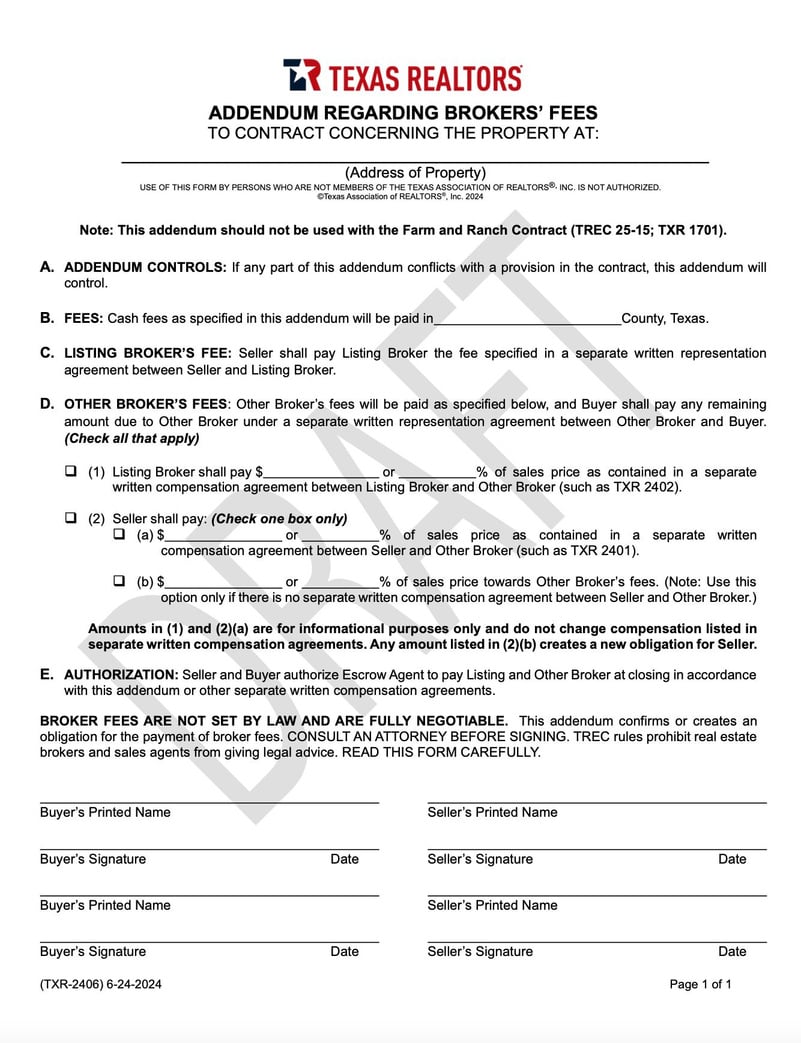

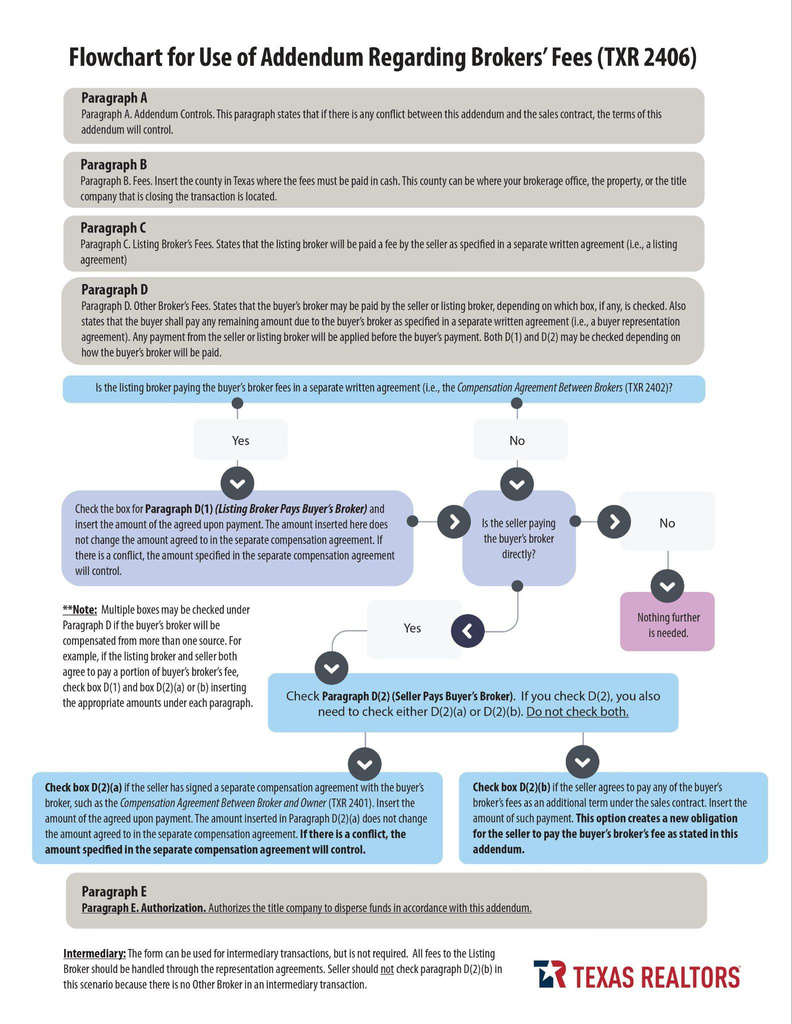

Addendum Regarding Broker Compensation (TXR 2406). This form is designed to be used as an addendum to the TREC residential

contracts (except the Farm and Ranch Contract) to record payment of buyer’s broker’s fees, including from a seller.

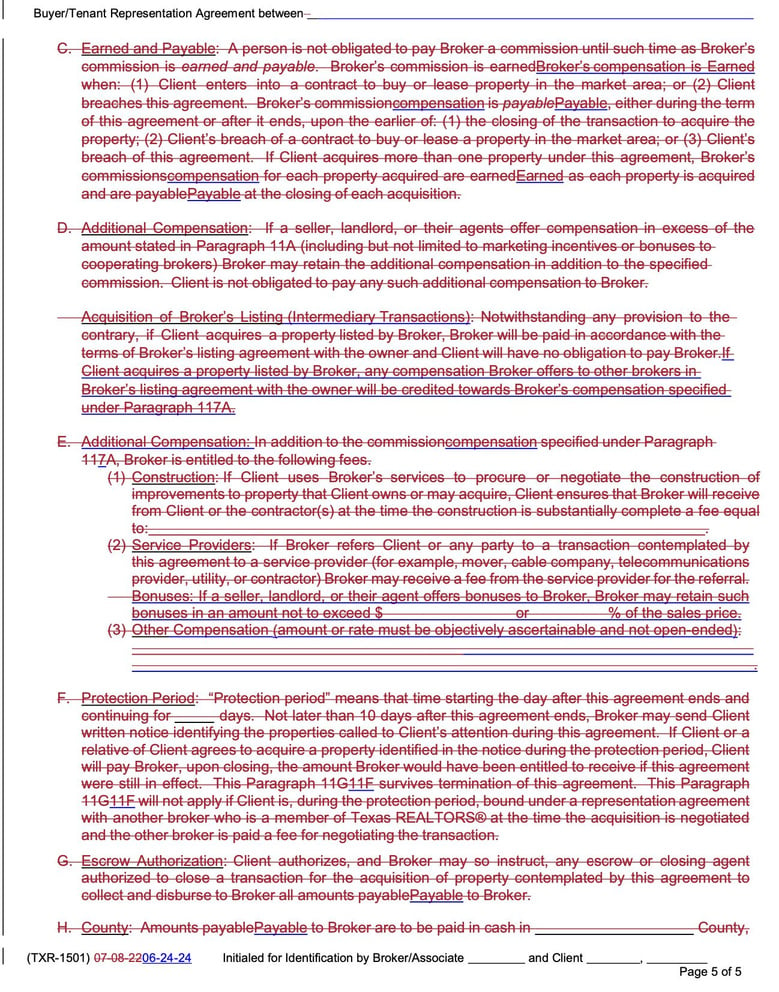

Amendment to Representation Agreement (temporary) (TXR 2701). This amendment can be used with listing and buyer/tenant

representation agreements to allow brokers under a current representation agreement to meet the requirements of the NAR

settlement—including the required disclosures and authorizations—that are required beginning August 17. This form is temporary and

will be pulled down at the appropriate time.

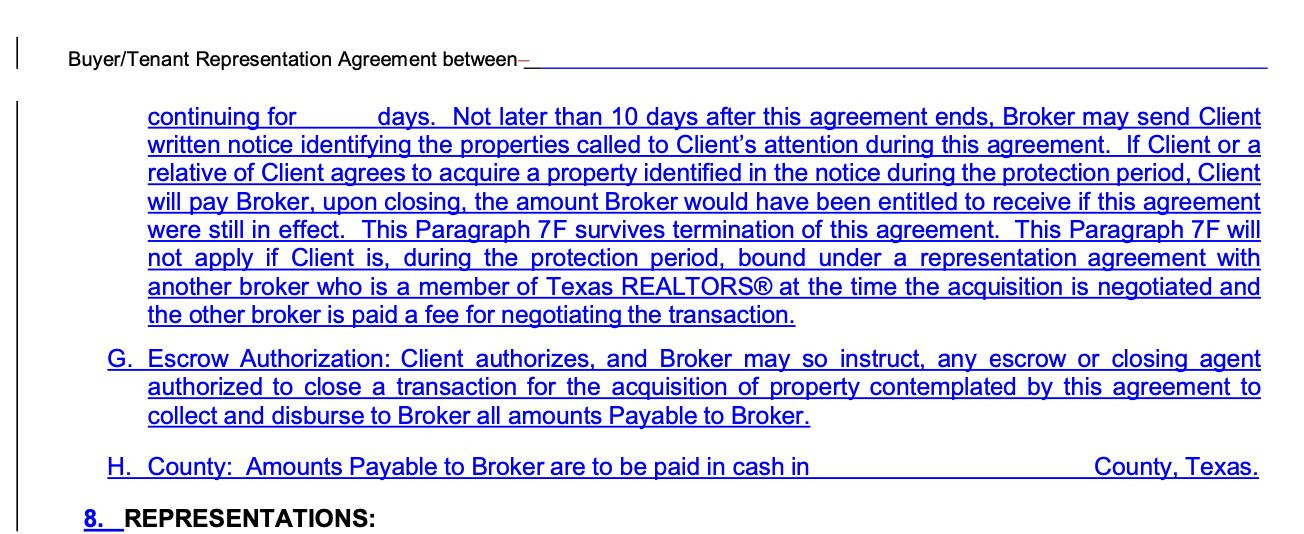

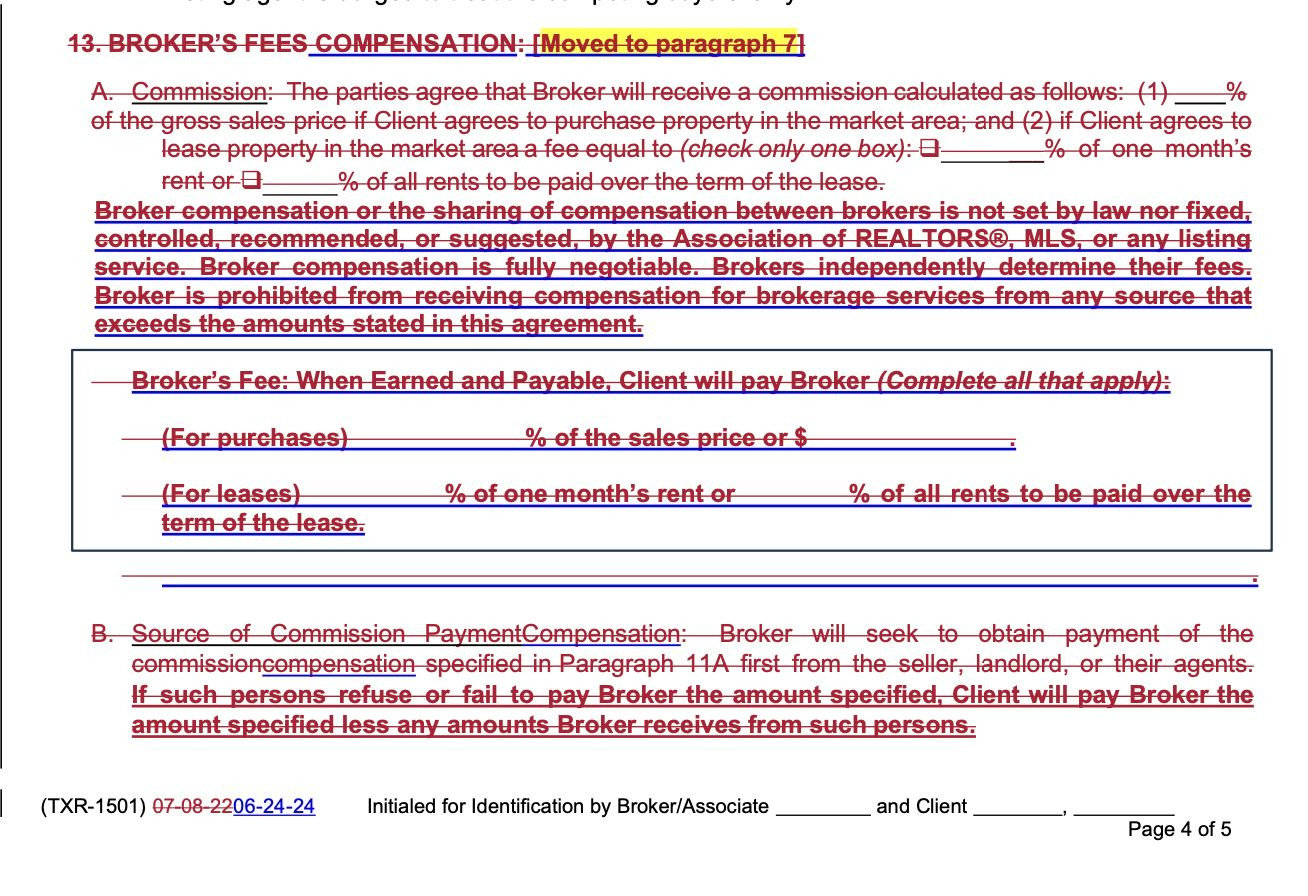

Residential Buyer/Tenant Representation Agreement – Long Form

(TXR 1501)

● ●

●

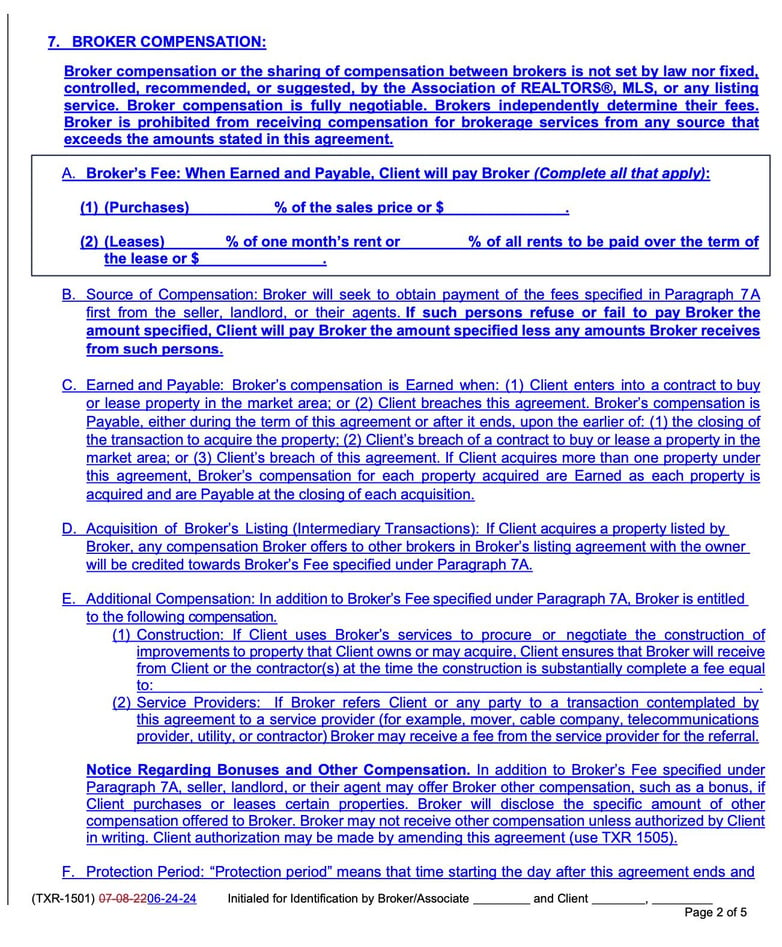

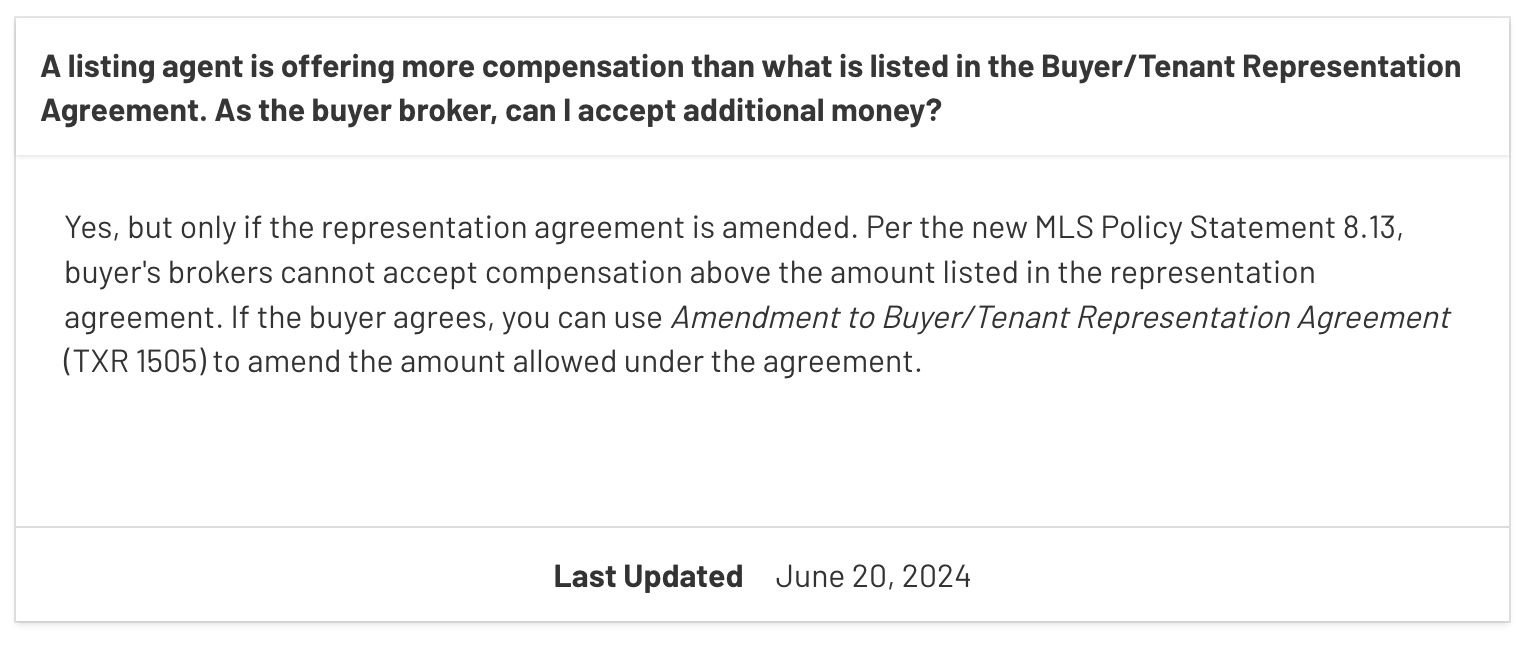

Paragraphs 7E(3) dealing with bonuses and 7E(4) dealing with other compensation have been deleted. A note regarding bonuses and other compensation has been added. The broker must disclose the specific amount of the bonus, and the client must authorize the additional compensation after the specific amount is known. Authorization can be done by amending the agreement. Rationale: Having blank lines to insert amounts for bonuses and other compensation would potentially lead to compensation that was not “objectively ascertainable” as required by the NAR settlement. Any compensation amount in the agreement must be a definite number or a rate that can be calculated to reach a definite number, such as percent of sales price. Therefore, the blank lines to insert compensation for bonuses or other compensation were removed from the buyer/tenant agreement. If a buyer or tenant is submitting an offer on a specific property that has a bonus or other compensation available to broker, members can use the amendment to get their clients authorization once a definite amount is known. Brokers should have a conversation about potential bonuses at the time the buyer/tenant agreement is signed.

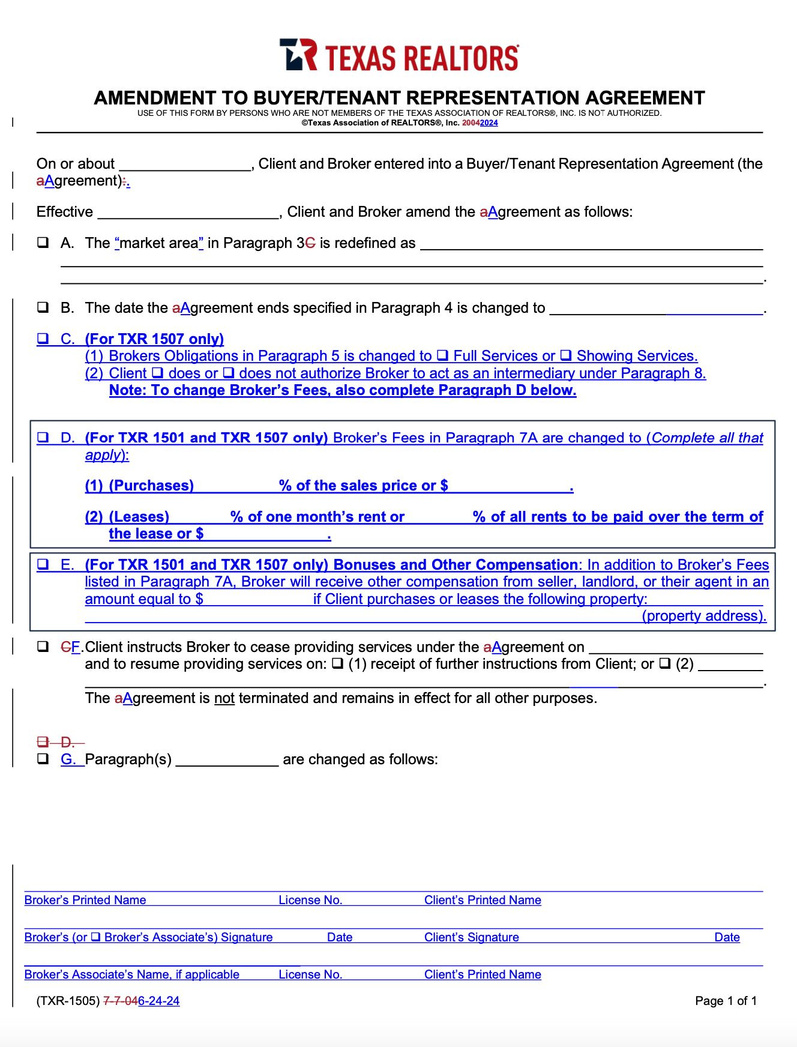

Amendment to Buyer/Tenant Representation Agreement

(TXR 1505)

●

Paragraph E was added as a place where the broker and client can amend the

Buyer/Tenant Representation

Agreement to get the client’s authorization for the broker to receive a definite amount of a bonus or other compensation. The association included a line to insert the property address where the bonus is being offered since the bonus would only apply to specific properties.

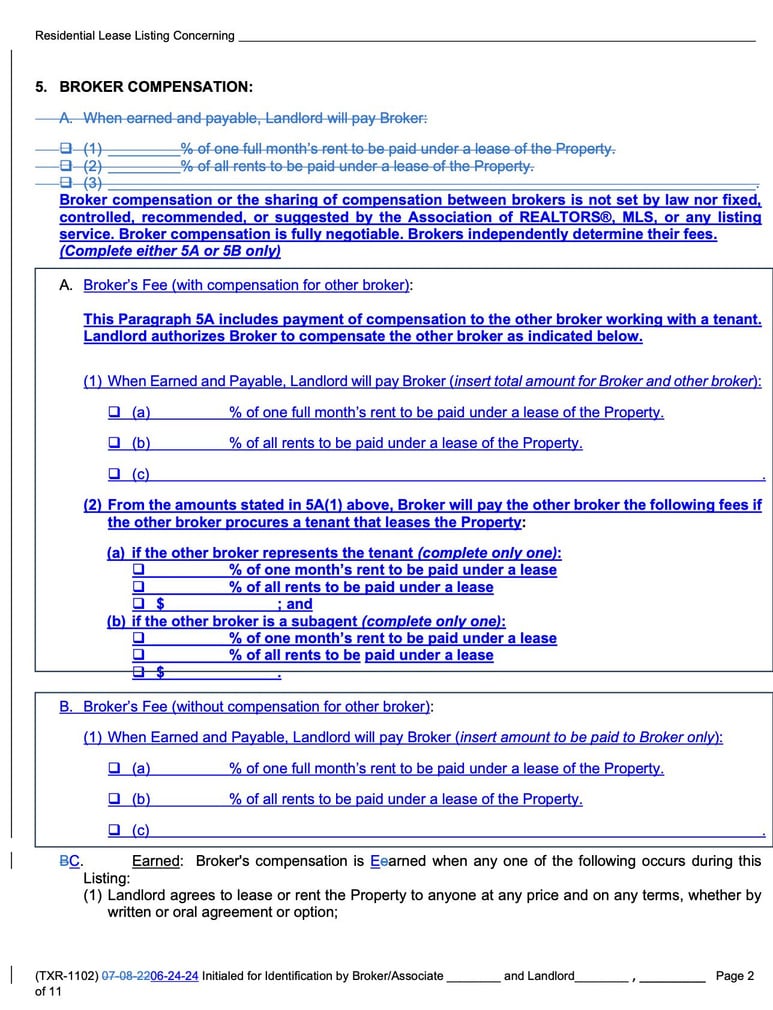

TAR 1102 Listing Agreement Changes: #5

TAR 1102 Listing Agreement Changes: #8

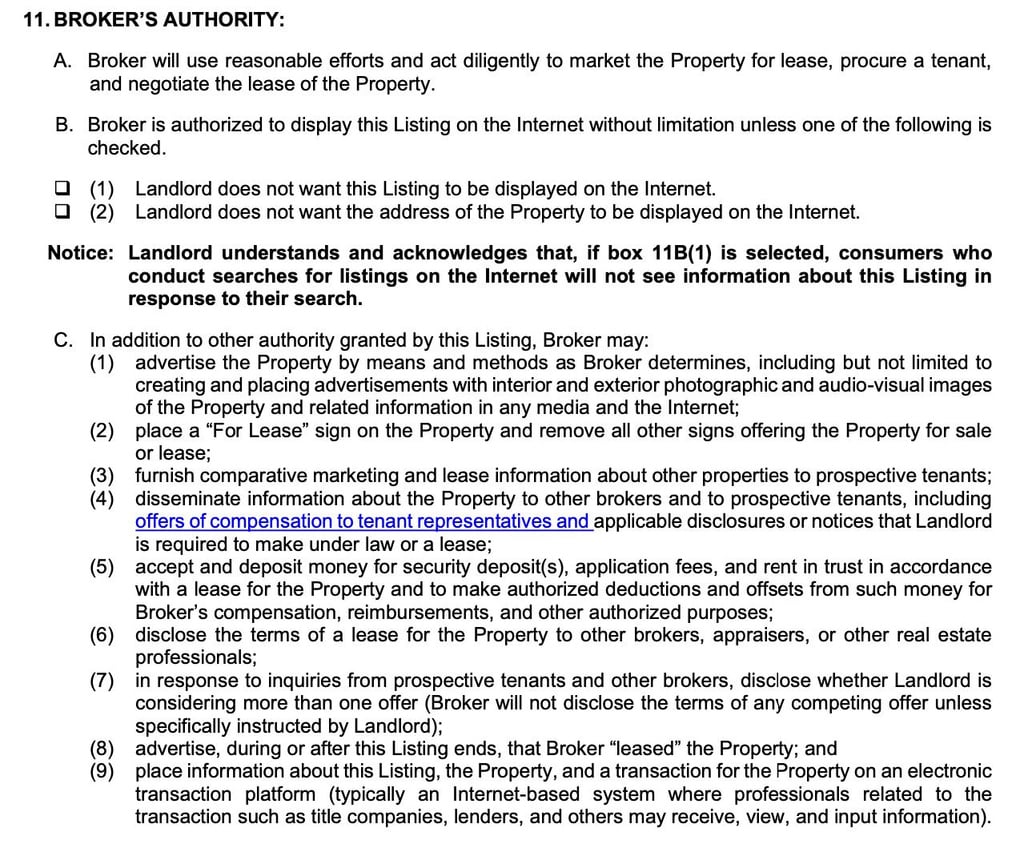

TAR 1102 Listing Agreement Changes: #11(C4)

Specific to the area you are knowledgeable in

This has been added

If client buys a property listed by broker, the fee will be credited to broker(in form of commission)

If there is a bonus, buyer has to be made aware & approve payment of bonus via use of TXR 1505

Moved to par 7

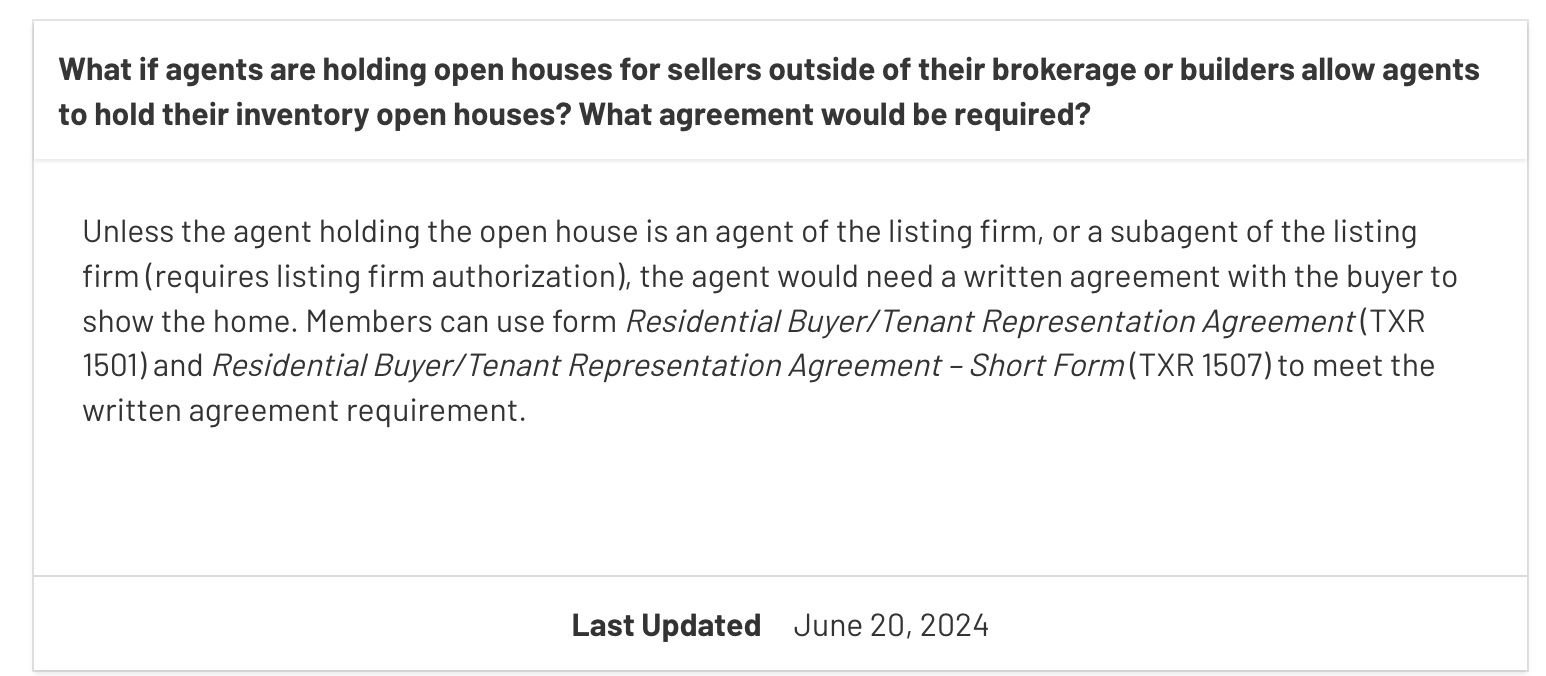

For Buyer Rep Agreements and/or Listing Agreements with a Version date

before 06/24/2024 USE TXR 1401

This ensures that your contract is valid and that we are authorized to pay the

other Broker

You can only receive the comp that is on your Buyer Rep Agreement

The Showing Services option can be used with a buyer or tenant who is not ready to sign a long- term exclusive representation agreement but still allows the broker to meet the MLS requirement of having a written agreement with a buyer to show a home. An amount must be addded, even it’s $0. YOUR SERVICES ARE NOT FREE AND CANNOT BE ADVERTISED AS FREE. o The remaining paragraphs of the agreement do not apply.

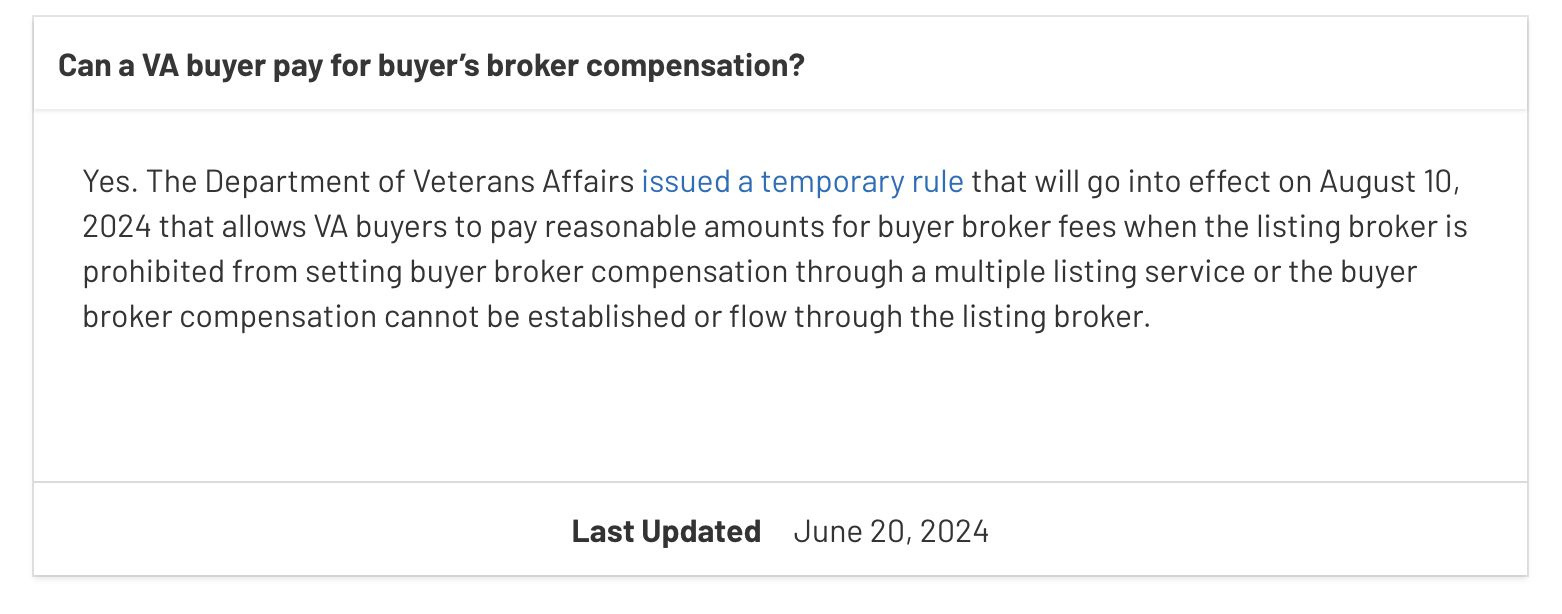

Negotiating, Timing, and the Broker-to-Broker Agreement

The NAR Code of Ethics requires REALTORS® to ascertain the terms of compensation, if any, before beginning efforts to accept the offer of cooperation or touring the home (See Article 3, Standard of Practice 3-1).

The listing broker and buyer broker may negotiate and agree to an offer of compensation prior to the buyer broker and buyer touring the home through a Broker-to-Broker agreement. Keep in mind that pursuant to the settlement practice changes, a buyer broker cannot accept compensation from any source that is more than the amount agreed to between the buyer broker and the buyer.

This form documents the payment of brokers’ fees in the transaction, including from a listing broker or seller to a buyer's broker. Note: This addendum should not be used with the Farm and Ranch

Contract

Is the

Addendum Regarding Brokers’ Fees

(TXR 2406) required on every transaction?

No, the Addendum Regarding Brokers’ Fees (TXR 2406) does not have to be used in every transaction. However, it should be used when the seller agrees to pay the buyer’s broker under the sales contract. In that case, Paragraph D(2)(b) must be checked to specify the amount and authorize the payment. For the other options listed in the Addendum Regarding Brokers’ Fees, the form can still be used to provide information to the title company on how the parties are handling brokers’ fees. So, it would be good to use but is not required.

When is the

Addendum Regarding Brokers’ Fees

(TXR 2406) executed?

The Addendum Regarding Brokers’ Fees is designed to be used when the seller is agreeing to pay buyer’s broker fees under a sales contract. It can be included as part of an offer package delivered to a seller. It may also be executed later in the transaction.

Addendum Regarding Brokers’

How will the title company, lender, etc. know how much to pay if Fees (TXR 2406) is not used?

Brokers can continue to use a compensation/commission disbursement authorization (CDA) form

supplied by their brokerage to notify title companies of disbursement instructions.How to use

Regarding Broker’s Fees (TXR 2406) Page 3 of 3

Addendum

Can the

Addendum Regarding Brokers’ Fees

(TXR 2406) be used in an intermediary transaction?

Yes, the form can be used in an intermediary transaction. The form provides notice to the title company of the parties’ agreement regarding the payment of broker’s fees. Also, the seller and buyer are authorizing the title company to disperse funds in accordance with prior compensation agreements, in this case, the listing and buyer representation agreements.

Thank you! Questions & AHA’s